Essay

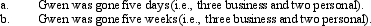

Gwen went to Paris on business.While there, she spent 60% of the time on business and 40% on vacation.How much of the air fare of $4,000 can she deduct based on the following assumptions:

Correct Answer:

Verified

Transportation costs for mixed use (i.e...

Transportation costs for mixed use (i.e...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q11: Employees who render an adequate accounting to

Q37: Nick Lee is a linebacker for the

Q59: During the year, Oscar travels from Raleigh

Q61: Match the statements that relate to each

Q65: A direct transfer of funds from a

Q66: The § 222 deduction for tuition and

Q69: Bob lives and works in Newark, NJ.He

Q114: Meg teaches the fifth grade at a

Q123: Nicole just retired as a partner in

Q134: Christopher just purchased an automobile for $40,000