Multiple Choice

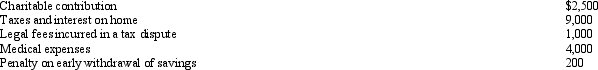

Janice is single, had gross income of $38,000, and incurred the following expenses:  Her AGI is:

Her AGI is:

A) $21,300.

B) $28,800.

C) $32,800.

D) $35,500.

E) $37,800.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: Salaries are considered an ordinary and necessary

Q53: In distinguishing whether an activity is a

Q58: Susan is a sales representative for a

Q61: Which of the following must be capitalized

Q87: Under what circumstances may a taxpayer deduct

Q96: Hobby activity expenses are deductible from AGI

Q115: If an item such as property taxes

Q117: Alfred's Enterprises, an unincorporated entity, pays employee

Q118: A cash basis taxpayer who charges an

Q119: Because it has only one owner, any