Essay

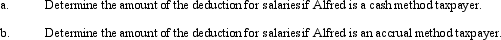

Alfred's Enterprises, an unincorporated entity, pays employee salaries of $92,000 during the year. At the end of the year, $9,000 of additional salaries have been earned but not paid until the beginning of the next year.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: Salaries are considered an ordinary and necessary

Q27: Which of the following is not a

Q53: In distinguishing whether an activity is a

Q87: Under what circumstances may a taxpayer deduct

Q114: Janice is single, had gross income of

Q115: If an item such as property taxes

Q118: A cash basis taxpayer who charges an

Q119: Because it has only one owner, any

Q122: Which of the following expenses associated with

Q144: In applying the $1 million limit on