Multiple Choice

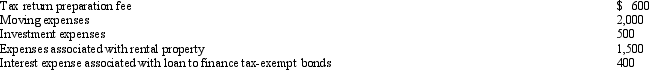

Cory incurred and paid the following expenses:  Calculate the amount that Cory can deduct (before any percentage limitations) .

Calculate the amount that Cory can deduct (before any percentage limitations) .

A) $5,000.

B) $4,600.

C) $3,000.

D) $1,500.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q29: Gladys owns a retail hardware store in

Q35: A vacation home at the beach which

Q36: For a vacation home to be classified

Q37: Benita incurred a business expense on December

Q38: Janet is the CEO for Silver, Inc.,

Q39: Robin and Jeff own an unincorporated hardware

Q39: Rex, a cash basis calendar year taxpayer,

Q80: For purposes of the § 267 loss

Q107: How can an individual's consultation with a

Q139: Briefly discuss the disallowance of deductions for