Essay

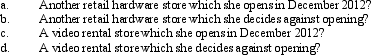

Gladys owns a retail hardware store in Tangipahoa.She is considering opening a business in Hammond, a community located 25 miles away.She incurs expenses of $60,000 in 2012 in investigating the feasibility and desirability of doing so.What amount can Gladys deduct in 2012 if the business is:

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Bridgett's son, Hubert, is $10,000 in arrears

Q25: Which of the following is incorrect?<br>A) All

Q26: If part of a shareholder/employee's salary is

Q27: Kitty runs a brothel (illegal under state

Q28: Vera is the CEO of Brunettes, a

Q34: Cory incurred and paid the following expenses:

Q36: For a vacation home to be classified

Q39: Robin and Jeff own an unincorporated hardware

Q80: For purposes of the § 267 loss

Q139: Briefly discuss the disallowance of deductions for