Multiple Choice

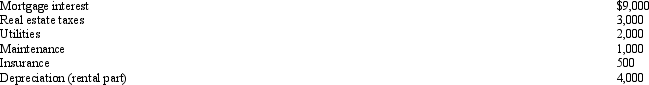

Robyn rents her beach house for 60 days and uses it for personal use for 30 days during the year.The rental income is $6,000 and the expenses are as follows:  Using the IRS approach, total expenses that Robyn can deduct on her tax return associated with the beach house are:

Using the IRS approach, total expenses that Robyn can deduct on her tax return associated with the beach house are:

A) $0.

B) $6,000.

C) $8,000.

D) $12,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: If a taxpayer operated an illegal business

Q48: Payments by a cash basis taxpayer of

Q76: Abner contributes $1,000 to the campaign of

Q77: Briefly explain the provisions regarding the deductibility

Q80: Martha rents part of her personal residence

Q82: Paula is the sole shareholder of Violet,

Q83: Brenda invested in the following stocks and

Q86: A political contribution to the Democratic Party

Q143: Bruce owns several sole proprietorships. Must Bruce

Q153: Tommy, an automobile mechanic employed by an