Essay

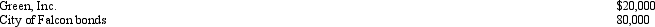

Brenda invested in the following stocks and bonds during 2012.

To finance the investments, she borrowed $100,000 from Swan Bank.Interest expense paid on the loan during 2012 was $6,000.During 2012, Brenda received $2,400 of dividend income from Green, Inc.and $3,200 of interest income on the municipal bonds.

To finance the investments, she borrowed $100,000 from Swan Bank.Interest expense paid on the loan during 2012 was $6,000.During 2012, Brenda received $2,400 of dividend income from Green, Inc.and $3,200 of interest income on the municipal bonds.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: If a taxpayer operated an illegal business

Q48: Payments by a cash basis taxpayer of

Q58: Which of the following is not deductible?<br>A)Moving

Q80: Martha rents part of her personal residence

Q81: Robyn rents her beach house for 60

Q82: Paula is the sole shareholder of Violet,

Q86: A political contribution to the Democratic Party

Q87: Austin, a single individual with a salary

Q143: Bruce owns several sole proprietorships. Must Bruce

Q153: Tommy, an automobile mechanic employed by an