Essay

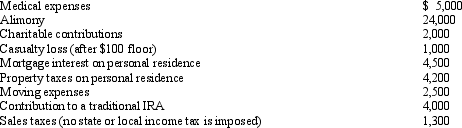

Austin, a single individual with a salary of $100,000, incurred and paid the following expenses during the year:

Calculate Austin's deductions for AGI.

Calculate Austin's deductions for AGI.

Correct Answer:

Verified

Only the following e...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Ordinary and necessary business expenses, other than

Q12: If a taxpayer operated an illegal business

Q58: Which of the following is not deductible?<br>A)Moving

Q82: Paula is the sole shareholder of Violet,

Q83: Brenda invested in the following stocks and

Q86: A political contribution to the Democratic Party

Q89: A salary that is classified as unreasonable

Q90: In order to protect against rent increases

Q91: All employment related expenses are classified as

Q143: Bruce owns several sole proprietorships. Must Bruce