Multiple Choice

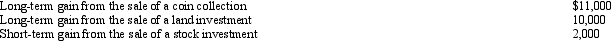

Kirby is in the 15% tax bracket and had the following capital asset transactions during 2012:  Kirby's tax consequences from these gains are as follows:

Kirby's tax consequences from these gains are as follows:

A) (5% ´ $10,000) + (15% ´ $13,000) .

B) (15% ´ $13,000) + (28% ´ $11,000) .

C) (0% ´ $10,000) + (15% ´ $13,000) .

D) (15% ´ $23,000) .

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Sarah furnishes more than 50% of the

Q78: Even if the individual does not spend

Q79: In 2012, Warren sold his personal use

Q81: During 2012, Trevor has the following capital

Q82: During the year, Irv had the following

Q84: Homer (age 68) and his wife Jean

Q88: In early 2012, Ben sold a yacht,

Q89: Under the Federal income tax formula for

Q122: Adjusted gross income (AGI) sets the ceiling

Q131: Once they reach age 65, many taxpayers