Essay

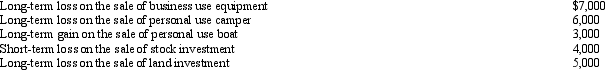

During the year, Irv had the following transactions:

How are these transactions handled for income tax purposes?

How are these transactions handled for income tax purposes?

Correct Answer:

Verified

Ordinary loss of $7,000 on the business ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Ordinary loss of $7,000 on the business ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q25: Sarah furnishes more than 50% of the

Q78: Even if the individual does not spend

Q79: In 2012, Warren sold his personal use

Q81: During 2012, Trevor has the following capital

Q83: Kirby is in the 15% tax bracket

Q84: Homer (age 68) and his wife Jean

Q89: Under the Federal income tax formula for

Q105: Maude's parents live in another state and

Q122: Adjusted gross income (AGI) sets the ceiling

Q131: Once they reach age 65, many taxpayers