Multiple Choice

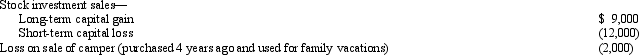

For the current year, David has salary income of $80,000 and the following property transactions:  What is David's AGI for the current year?

What is David's AGI for the current year?

A) $76,000.

B) $77,000.

C) $78,000.

D) $89,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q25: Sarah furnishes more than 50% of the

Q88: In early 2012, Ben sold a yacht,

Q89: A decrease in a taxpayer's AGI could

Q89: Under the Federal income tax formula for

Q91: Wilma, age 70 and single, is claimed

Q92: Derek, age 46, is a surviving spouse.If

Q93: Roy and Linda were divorced in 2011.The

Q94: Married taxpayers who file separately cannot later

Q95: Emma had the following transactions for 2012:<br>

Q131: Once they reach age 65, many taxpayers