Essay

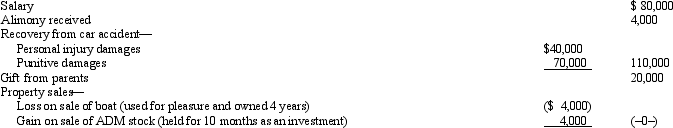

Emma had the following transactions for 2012:

What is Emma's AGI for 2012?

What is Emma's AGI for 2012?

Correct Answer:

Verified

$158,000.$80,000 (salary) + $4,000 (alim...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$158,000.$80,000 (salary) + $4,000 (alim...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q16: In terms of income tax consequences, abandoned

Q90: For the current year, David has salary

Q91: Wilma, age 70 and single, is claimed

Q92: Derek, age 46, is a surviving spouse.If

Q93: Roy and Linda were divorced in 2011.The

Q94: Married taxpayers who file separately cannot later

Q96: Which, if any, of the following is

Q97: Warren, age 17, is claimed as a

Q98: Buddy and Hazel are ages 72 and

Q99: Which of the following taxpayers may file