Essay

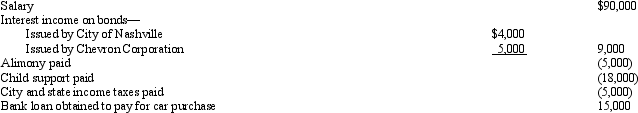

Ethan had the following transactions during 2012:

What is Ethan's AGI for 2012?

What is Ethan's AGI for 2012?

Correct Answer:

Verified

$90,000.$90,000 (salary) + $5,000 (inter...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$90,000.$90,000 (salary) + $5,000 (inter...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q14: For the qualifying relative category (for dependency

Q15: Jason and Peg are married and file

Q16: In terms of the tax formula applicable

Q17: During the year, Kim sold the following

Q18: Keith, age 17 and single, earns $3,000

Q20: Contrast the tax consequences resulting from the

Q24: In terms of the tax formula applicable

Q79: In meeting the criteria of a qualifying

Q82: Because they appear on page 1 of

Q123: For the year a spouse dies, the