Essay

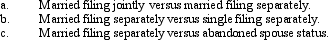

Contrast the tax consequences resulting from the following filing status situations:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q15: Jason and Peg are married and file

Q16: In terms of the tax formula applicable

Q17: During the year, Kim sold the following

Q18: Keith, age 17 and single, earns $3,000

Q19: Ethan had the following transactions during 2012:<br>

Q24: In terms of the tax formula applicable

Q79: In meeting the criteria of a qualifying

Q82: Because they appear on page 1 of

Q120: Ed is divorced and maintains a home

Q123: For the year a spouse dies, the