Multiple Choice

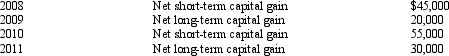

Bear Corporation has a net short-term capital gain of $35,000 and a net long-term capital loss of $200,000 during 2012.Bear Corporation has taxable income from other sources of $600,000.Prior years' transactions included the following:  Compute the amount of Bear's capital loss carryover to 2013.

Compute the amount of Bear's capital loss carryover to 2013.

A) $0.

B) $60,000.

C) $105,000.

D) $165,000.

E) $200,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Under the check-the-box Regulations, a two-owner LLC

Q21: What is a limited liability company? What

Q47: Explain the rules regarding the accounting periods

Q58: What is the annual required estimated tax

Q95: Robin Corporation, a calendar year C corporation,

Q96: Jessica, a cash basis individual, is a

Q97: Heron Corporation, a calendar year C corporation,

Q101: Rose is a 50% partner in Wren

Q102: Almond Corporation, a calendar year C corporation,

Q103: During the current year, Kingbird Corporation (a