Multiple Choice

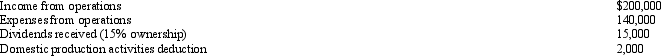

During the current year, Kingbird Corporation (a calendar year C corporation) had the following income and expenses:  On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) . Determine Kingbird's charitable contribution deduction for the current year.

On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) . Determine Kingbird's charitable contribution deduction for the current year.

A) $9,000.

B) $7,500.

C) $6,650.

D) $6,450.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Under the check-the-box Regulations, a two-owner LLC

Q21: What is a limited liability company? What

Q47: Explain the rules regarding the accounting periods

Q99: Bear Corporation has a net short-term capital

Q101: Rose is a 50% partner in Wren

Q102: Almond Corporation, a calendar year C corporation,

Q105: During the current year, Waterthrush Company had

Q106: Ivory Corporation, a calendar year, accrual method

Q107: Grebe Corporation, a closely held corporation that

Q108: If a C corporation uses straight-line depreciation