Multiple Choice

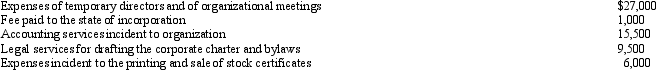

Emerald Corporation, a calendar year C corporation, was formed and began operations on April 1, 2012. The following expenses were incurred during the first tax year (April 1 through December 31, 2012) of operations:  Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2012?

Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2012?

A) $0.

B) $4,550.

C) $5,000.

D) $7,400.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Double taxation of corporate income results because

Q75: Jade Corporation, a C corporation, had $100,000

Q76: As a general rule, a personal service

Q77: Warbler Corporation, an accrual method regular corporation,

Q79: No dividends received deduction is allowed unless

Q80: Ed, an individual, incorporates two separate businesses

Q82: Lucinda is a 60% shareholder in Rhea

Q83: Copper Corporation, a C corporation, had gross

Q99: Briefly describe the charitable contribution deduction rules

Q109: Schedule M-3 is similar to Schedule M-1