Essay

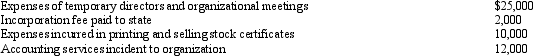

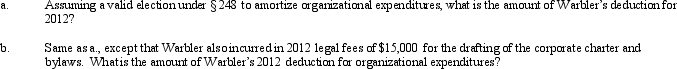

Warbler Corporation, an accrual method regular corporation, was formed and began operations on March 1, 2012. The following expenses were incurred during its first year of operations (March 1 - December 31, 2012):

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q21: Double taxation of corporate income results because

Q73: Ostrich, a C corporation, has a net

Q75: Jade Corporation, a C corporation, had $100,000

Q76: As a general rule, a personal service

Q79: No dividends received deduction is allowed unless

Q79: Emerald Corporation, a calendar year C corporation,

Q80: Ed, an individual, incorporates two separate businesses

Q82: Lucinda is a 60% shareholder in Rhea

Q89: In the current year,Oriole Corporation donated a

Q109: Schedule M-3 is similar to Schedule M-1