Multiple Choice

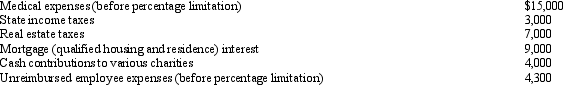

Mitch, who is single and has no dependents, had AGI of $100,000 in 2012.His potential itemized deductions were as follows:  What is the amount of Mitch's AMT adjustment for itemized deductions for 2012?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2012?

A) $14,800.

B) $16,800.

C) $19,300.

D) $25,800.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q34: The deduction for personal and dependency exemptions

Q40: How can interest on a private activity

Q93: Identify an AMT adjustment that applies for

Q112: Which of the following statements is correct?<br>A)The

Q113: The required adjustment for AMT purposes for

Q115: Evan is a contractor who constructs both

Q116: Kaya is in the 33% marginal tax

Q118: Ashly is able to reduce her regular

Q121: What is the relationship between taxable income

Q122: Prior to the effect of the tax