Multiple Choice

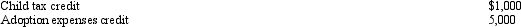

Prior to the effect of the tax credits, Justin's regular income tax liability is $200,000 and his tentative AMT is $195,000.Justin has the following credits:  Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

A) $190,000.

B) $194,000.

C) $195,000.

D) $200,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q34: The deduction for personal and dependency exemptions

Q40: How can interest on a private activity

Q115: Evan is a contractor who constructs both

Q115: Will all AMT adjustments reverse? That is,do

Q116: Kaya is in the 33% marginal tax

Q117: Mitch, who is single and has no

Q118: Ashly is able to reduce her regular

Q121: What is the relationship between taxable income

Q123: The recognized gain for regular income tax

Q124: In May 2011, Egret, Inc.issues options to