Essay

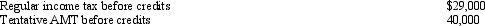

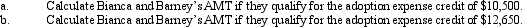

Bianca and Barney have the following for 2012:

Correct Answer:

Verified

Only $11,000 of t...

Only $11,000 of t...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q13: Are the AMT rates for the individual

Q49: Eula owns a mineral property that had

Q50: A tax preference can increase or decrease

Q51: Cindy, who is single and has no

Q52: The amount of the deduction for medical

Q53: The AMT can be calculated using either

Q55: For regular income tax purposes, Yolanda, who

Q56: Sand Corporation, a calendar year taxpayer, has

Q57: Tad and Audria, who are married filing

Q58: Use the following data to calculate Diane's