Essay

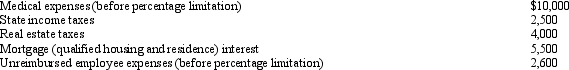

Cindy, who is single and has no dependents, has adjusted gross income of $50,000 in 2012.Her potential itemized deductions are as follows:

What is the amount of Cindy's AMT adjustment for itemized deductions for 2012?

What is the amount of Cindy's AMT adjustment for itemized deductions for 2012?

Correct Answer:

Verified

Cindy's adjustments ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: Moore incurred circulation expenditures of $300,000 in

Q47: If Abby's alternative minimum taxable income exceeds

Q49: Eula owns a mineral property that had

Q50: A tax preference can increase or decrease

Q52: The amount of the deduction for medical

Q53: The AMT can be calculated using either

Q54: Bianca and Barney have the following for

Q55: For regular income tax purposes, Yolanda, who

Q56: Sand Corporation, a calendar year taxpayer, has

Q84: Income from some long-term contracts can be