Essay

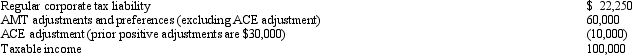

Smoke, Inc., provides you with the following information:

Calculate Smoke's AMT for 2012.

Calculate Smoke's AMT for 2012.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: For the ACE adjustment, discuss the relationship

Q3: Which of the following itemized deductions definitely

Q4: Tad is a vice-president of Ruby Corporation.

Q5: The AMT adjustment for mining exploration and

Q6: In 2012, Sean incurs $90,000 of mining

Q7: Celia and Amos, who are married filing

Q8: In calculating her taxable income, Rhonda deducts

Q9: In determining the amount of the AMT

Q10: Prior to the effect of tax credits,

Q11: In 2012, Louise incurs circulation expenses of