Essay

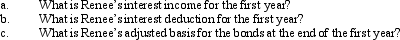

Renee purchases taxable bonds with a face value of $200,000 for $212,000.The annual interest paid on the bonds is $10,000.Assume Renee elects to amortize the bond premium.The total premium amortization for the first year is $1,600.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q10: Under what circumstances may a partial §

Q23: Bill is considering two options for selling

Q25: Don, who is single, sells his personal

Q27: a. Orange Corporation exchanges a warehouse located

Q29: Boyd acquired tax-exempt bonds for $430,000 in

Q48: Mandy and Greta form Tan, Inc., by

Q73: Define a bargain purchase of property and

Q106: Explain how the sale of investment property

Q159: Define an involuntary conversion.

Q208: Discuss the logic for mandatory deferral of