Essay

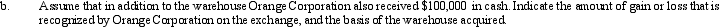

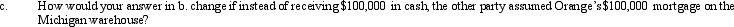

a. Orange Corporation exchanges a warehouse located in Michigan (adjusted basis of $560,000) for a warehouse located in Ohio (adjusted basis of $450,000; fair market value of $525,000).Indicate the amount of gain or loss that is recognized by Orange Corporation on the exchange, and the basis of the warehouse acquired.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Under what circumstances may a partial §

Q22: Janet, age 68, sells her principal residence

Q23: Bill is considering two options for selling

Q25: Don, who is single, sells his personal

Q28: Renee purchases taxable bonds with a face

Q29: Boyd acquired tax-exempt bonds for $430,000 in

Q48: Mandy and Greta form Tan, Inc., by

Q73: Define a bargain purchase of property and

Q106: Explain how the sale of investment property

Q159: Define an involuntary conversion.