Essay

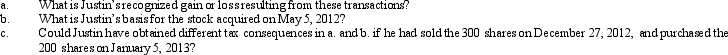

Justin owns 1,000 shares of Oriole Corporation common stock (adjusted basis of $9,800). On April 27, 2012, he sells 300 shares for $2,800, while on May 5, 2012, he purchases 200 shares for $2,500.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q32: For a corporate distribution of cash or

Q73: Why is it generally undesirable to pass

Q80: Sammy exchanges equipment used in his business

Q81: Misty owns stock in Violet, Inc., for

Q82: For gifts made after 1976, when will

Q84: Describe the relationship between the recovery of

Q85: Evelyn's office building is destroyed by fire

Q96: Edward, age 52, leased a house for

Q146: Distinguish between a direct involuntary conversion and

Q151: For disallowed losses on related-party transactions, who