Essay

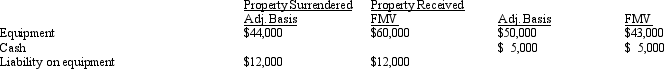

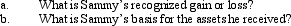

Sammy exchanges equipment used in his business in a like-kind exchange.The property exchanged is as follows:

The other party assumes the liability.

The other party assumes the liability.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q73: Why is it generally undesirable to pass

Q81: Misty owns stock in Violet, Inc., for

Q82: For gifts made after 1976, when will

Q83: Justin owns 1,000 shares of Oriole Corporation

Q84: Describe the relationship between the recovery of

Q85: Evelyn's office building is destroyed by fire

Q96: Edward, age 52, leased a house for

Q190: Joseph converts a building (adjusted basis of

Q234: What is the easiest way for a

Q243: Tariq sold certain U.S. Government bonds and