Essay

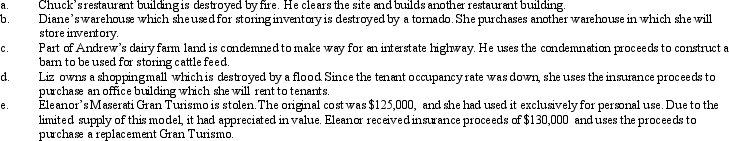

For each of the following involuntary conversions, determine if the property qualifies as replacement property.

Correct Answer:

Verified

All of the replacements qualify as repla...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

All of the replacements qualify as repla...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q24: Nigel purchased a blending machine for $125,000

Q32: For a corporate distribution of cash or

Q82: For gifts made after 1976, when will

Q83: Justin owns 1,000 shares of Oriole Corporation

Q84: Describe the relationship between the recovery of

Q85: Evelyn's office building is destroyed by fire

Q91: Sam and Cheryl, husband and wife, own

Q92: Larry, who lived in Maine, acquired a

Q146: Distinguish between a direct involuntary conversion and

Q151: For disallowed losses on related-party transactions, who