Essay

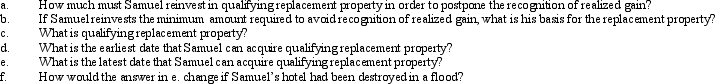

Samuel's hotel is condemned by the City Housing Authority on July 5, 2012, for which he is paid condemnation proceeds of $950,000.He first received official notification of the pending condemnation on May 2, 2012.Samuel's adjusted basis for the hotel is $600,000 and he uses a fiscal year for tax purposes with a September 30 tax year-end.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: What effect do the assumption of liabilities

Q27: Discuss the application of holding period rules

Q37: On September 18, 2012, Jerry received land

Q40: Eunice Jean exchanges land held for investment

Q43: Faith inherits an undivided interest in a

Q45: Hubert purchases Fran's jewelry store for $950,000.The

Q46: Use the following data to determine the

Q49: Under what circumstance is there recognition of

Q94: Under what circumstances will a distribution by

Q156: What requirements must be satisfied to receive