Essay

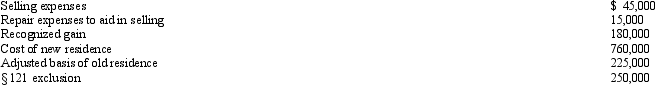

Use the following data to determine the sales price of Etta's principal residence and the realized gain.She is not married.The sale of the old residence qualifies for the § 121 exclusion.

Correct Answer:

Verified

The sale of residence model can be used ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: Samuel's hotel is condemned by the City

Q43: Faith inherits an undivided interest in a

Q45: Hubert purchases Fran's jewelry store for $950,000.The

Q47: Define qualified small business stock under §

Q48: Hilary receives $10,000 for a 13-foot wide

Q49: Can related parties take advantage of the

Q50: Alice is terminally ill and does not

Q94: Under what circumstances will a distribution by

Q117: Identify two tax planning techniques that can

Q156: What requirements must be satisfied to receive