Essay

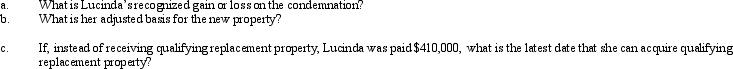

Lucinda, a calendar year taxpayer, owned a rental property with an adjusted basis of $312,000 in a major coastal city.Her property was condemned by the city government on October 12, 2012.In order to build a convention center, Lucinda eventually received qualified replacement property from the city government on March 9, 2013.This new property has a fair market value of $410,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q49: Can related parties take advantage of the

Q50: Alice is terminally ill and does not

Q52: Patty's factory building, which has an adjusted

Q56: Mitchell owned an SUV that he had

Q57: For the following exchanges, indicate which qualify

Q58: Taylor owns common stock in Taupe, Inc.,

Q64: Peggy uses a delivery van in her

Q117: Identify two tax planning techniques that can

Q157: Discuss the treatment of losses from involuntary

Q162: Libby's principal residence is destroyed by a