Essay

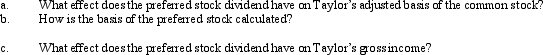

Taylor owns common stock in Taupe, Inc., with an adjusted basis of $100,000.She receives a preferred stock dividend which is nontaxable.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q54: Lucinda, a calendar year taxpayer, owned a

Q56: Mitchell owned an SUV that he had

Q57: For the following exchanges, indicate which qualify

Q60: Elbert gives stock worth $28,000 (no gift

Q61: Lynn transfers her personal use automobile to

Q62: On January 15 of the current taxable

Q63: Felix gives 100 shares of stock to

Q64: Peggy uses a delivery van in her

Q157: Discuss the treatment of losses from involuntary

Q162: Libby's principal residence is destroyed by a