Multiple Choice

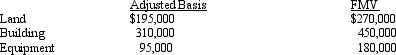

Mona purchased a business from Judah for $1,000,000. Judah's records and an appraiser provided her with the following information regarding the assets purchased:  What is Mona's adjusted basis for the land, building, and equipment?

What is Mona's adjusted basis for the land, building, and equipment?

A) Land $270,000, building $450,000, equipment $180,000.

B) Land $195,000, building $575,000, equipment $230,000.

C) Land $195,000, building $310,000, equipment $95,000.

D) Land $270,000, building $521,429, equipment $208,571.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Broker's commissions, legal fees, and points paid

Q69: Section 1033 (nonrecognition of gain from an

Q79: A taxpayer who sells his or her

Q82: Alvin is employed by an automobile dealership

Q161: Which of the following is correct?<br>A) The

Q192: In order to qualify for like-kind exchange

Q193: If Wal-Mart stock increases in value during

Q195: Taxpayer owns a home in Atlanta.His company

Q271: The holding period of replacement property where

Q284: The basis of personal use property converted