Multiple Choice

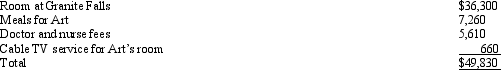

Liz, who is single, travels frequently on business. Art, Liz's 84-year-old dependent grandfather, lived with Liz until this year when he moved to Granite Falls Nursing Home because he needs daily medical and nursing care. During the year, Liz made the following payments to Granite Falls on behalf of Art:  Granite Falls has medical staff in residence. Disregarding the 7.5% floor, how much, if any, of these expenses qualifies as a medical expense deduction by Liz?

Granite Falls has medical staff in residence. Disregarding the 7.5% floor, how much, if any, of these expenses qualifies as a medical expense deduction by Liz?

A) $5,610.

B) $41,910.

C) $49,170.

D) $49,830.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: The election to itemize is appropriate when

Q12: Chad pays the medical expenses of his

Q13: Pat died this year.Before she died, Pat

Q15: Your friend Scotty informs you that he

Q16: Donald owns a principal residence in Chicago,

Q18: Any capital asset donated to a public

Q19: In 2012, Brandon, age 72, paid $3,000

Q21: Marilyn, Ed's daughter who would otherwise qualify

Q22: In 2005, Ross, who is single, purchased

Q98: Fees for automobile inspections, automobile titles and