Multiple Choice

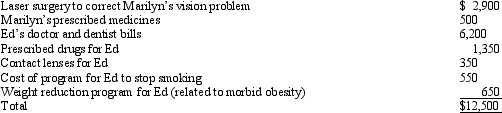

Marilyn, Ed's daughter who would otherwise qualify as his dependent, filed a joint return with her husband Henry. Ed, who had AGI of $150,000, incurred the following expenses:  Ed has a medical expense deduction of:

Ed has a medical expense deduction of:

A) $0.

B) $50.

C) $1,250.

D) $12,500.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: The election to itemize is appropriate when

Q16: Donald owns a principal residence in Chicago,

Q17: Liz, who is single, travels frequently on

Q18: Any capital asset donated to a public

Q19: In 2012, Brandon, age 72, paid $3,000

Q22: In 2005, Ross, who is single, purchased

Q23: Diego, who is single and lives alone,

Q24: Marilyn is employed as an architect.For calendar

Q26: Rosie owned stock in Acme Corporation that

Q53: Pedro's child attends a school operated by