Multiple Choice

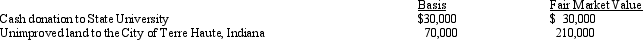

Karen, a calendar year taxpayer, made the following donations to qualified charitable organizations in 2012:  The land had been held as an investment and was acquired 4 years ago.Shortly after receipt, the City of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction is:

The land had been held as an investment and was acquired 4 years ago.Shortly after receipt, the City of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction is:

A) $84,000 if the reduced deduction election is not made.

B) $100,000 if the reduced deduction election is not made.

C) $165,000 if the reduced deduction election is not made.

D) $170,000 if the reduced deduction election is made.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q46: Antonio sold his personal residence to Mina

Q47: In the year of her death, Maria

Q48: If certain conditions are met, a buyer

Q49: Phyllis, a calendar year cash basis taxpayer

Q50: Erica, Carol's daughter, has a mild form

Q52: Samuel, an individual who has been physically

Q53: During 2012, Hugh, a self-employed individual, paid

Q54: Maria traveled to Rochester, Minnesota, with her

Q55: Joe, a cash basis taxpayer, took out

Q56: The phaseout of certain itemized deductions has