Multiple Choice

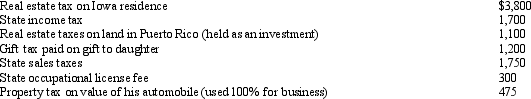

During 2012, Hugh, a self-employed individual, paid the following amounts:  What is the maximum amount Hugh can claim as taxes in itemizing deductions from AGI?

What is the maximum amount Hugh can claim as taxes in itemizing deductions from AGI?

A) $6,600.

B) $6,650.

C) $7,850.

D) $8,625.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q48: If certain conditions are met, a buyer

Q49: Phyllis, a calendar year cash basis taxpayer

Q50: Erica, Carol's daughter, has a mild form

Q51: Karen, a calendar year taxpayer, made the

Q52: Samuel, an individual who has been physically

Q54: Maria traveled to Rochester, Minnesota, with her

Q55: Joe, a cash basis taxpayer, took out

Q56: The phaseout of certain itemized deductions has

Q57: Charles, who is single, had AGI of

Q58: Employee business expenses for travel qualify as