Essay

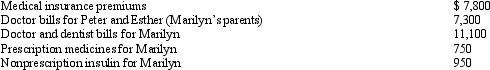

Marilyn is employed as an architect.For calendar year 2012, she had AGI of $204,000 and paid the following medical expenses:

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return. Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2012 and received the reimbursement in January 2013.What is Marilyn's maximum allowable medical expense deduction for 2012?

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return. Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2012 and received the reimbursement in January 2013.What is Marilyn's maximum allowable medical expense deduction for 2012?

Correct Answer:

Verified

Marilyn's medical expense deduction is $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: The election to itemize is appropriate when

Q19: In 2012, Brandon, age 72, paid $3,000

Q21: Marilyn, Ed's daughter who would otherwise qualify

Q22: In 2005, Ross, who is single, purchased

Q23: Diego, who is single and lives alone,

Q26: Rosie owned stock in Acme Corporation that

Q27: Warren sold his personal residence to Alicia

Q28: A taxpayer pays points to obtain financing

Q44: Harry and Sally were divorced three years

Q53: Pedro's child attends a school operated by