Essay

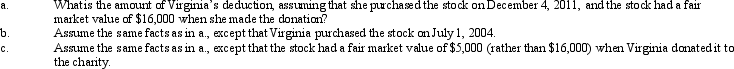

Virginia had AGI of $100,000 in 2012. She donated Amber Corporation stock with a basis of $9,000 to a qualified charitable organization on July 5, 2012.

Correct Answer:

Verified

General discussion. The deduction for a ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

General discussion. The deduction for a ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q40: Any personal expenditures not specifically allowed as

Q41: George is single, has AGI of $255,300,

Q42: In 2012, Shirley sold her personal residence

Q43: David, a single taxpayer, took out a

Q44: In April 2012, Bertie, a calendar year

Q46: Antonio sold his personal residence to Mina

Q47: In the year of her death, Maria

Q48: If certain conditions are met, a buyer

Q49: Phyllis, a calendar year cash basis taxpayer

Q50: Erica, Carol's daughter, has a mild form