Essay

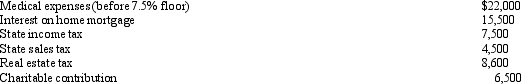

George is single, has AGI of $255,300, and incurs the following expenditures in 2012.

What is the amount of itemized deductions George may claim?

What is the amount of itemized deductions George may claim?

Correct Answer:

Verified

Itemized deductions: $2,852 [$22,000 (me...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Itemized deductions: $2,852 [$22,000 (me...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q37: During 2012, Nancy paid the following taxes:

Q38: Tom is advised by his family physician

Q39: For all of 2012, Aaron (a calendar

Q40: Any personal expenditures not specifically allowed as

Q42: In 2012, Shirley sold her personal residence

Q43: David, a single taxpayer, took out a

Q44: In April 2012, Bertie, a calendar year

Q45: Virginia had AGI of $100,000 in 2012.

Q46: Antonio sold his personal residence to Mina

Q61: Letha incurred a $1,600 prepayment penalty to