Essay

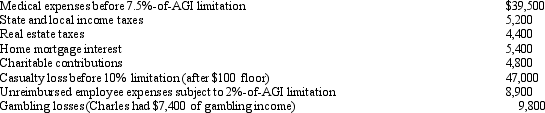

Charles, who is single, had AGI of $400,000 during 2012. He incurred the following expenses and losses during the year.

Compute Charles's total itemized deductions for the year.

Compute Charles's total itemized deductions for the year.

Correct Answer:

Verified

Charles's itemized d...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q52: Samuel, an individual who has been physically

Q53: During 2012, Hugh, a self-employed individual, paid

Q54: Maria traveled to Rochester, Minnesota, with her

Q55: Joe, a cash basis taxpayer, took out

Q56: The phaseout of certain itemized deductions has

Q58: Employee business expenses for travel qualify as

Q59: In applying the percentage limitations, carryovers of

Q61: Joe, who is in the 33% tax

Q62: Brad, who uses the cash method of

Q78: In order to dissuade his pastor from