Multiple Choice

Answer the following question(s) using the information below:

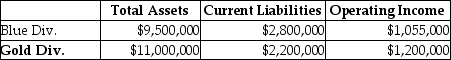

Springfield Corporation,whose tax rate is 40%,has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%,and equity capital with a market value of $12,000,000 and a cost of equity of 12%.Springfield has two operating divisions,the Blue division and the Gold division,with the following financial measures for the current year:

-What is Economic Value Added () for the Gold Division?

A) -$283,200

B) -$82,560

C) $196,800

D) $397,440

E) -$195,200

Correct Answer:

Verified

Correct Answer:

Verified

Q50: Current cost is defined as the cost

Q68: Which type of compensation is most prevalent

Q77: National Can Company has three divisions,Eastern,Midwestern,and Western.Because

Q78: Coptermagic Company supplies helicopters to corporate clients.Coptermagic

Q94: The first step in designing accounting based

Q117: Which of the following approaches include investment

Q123: Team incentives encourage cooperation by<br>A)forcing people to

Q137: A control system that attempts to focus

Q145: The imputed cost of an investment is

Q157: Some companies present financial and non-financial performance