Essay

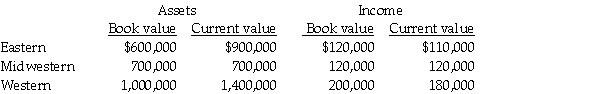

National Can Company has three divisions,Eastern,Midwestern,and Western.Because of very different accounting methods and inflation rates in different countries it is considering multiple evaluation measures.Information gathered about the divisions for the year just ended follows:

The company is currently using a required rate of return of 15 percent.

Required:

a.Compute the ROI using both book value and current value for all divisions.Round to three decimal places.

b.Compute residual income using book value and current value for all divisions.

c.Does book value or current value provide the better basis for performance evaluation? Why? Which division is the most successful?

Correct Answer:

Verified

a.

Book value ROI: Eastern = $120,000/$6...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Book value ROI: Eastern = $120,000/$6...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Use the information below to answer the

Q50: Current cost is defined as the cost

Q68: Which type of compensation is most prevalent

Q74: Answer the following question(s)using the information below:<br>Springfield

Q78: Coptermagic Company supplies helicopters to corporate clients.Coptermagic

Q80: Randall Ltd.reported the following results for its

Q94: The first step in designing accounting based

Q98: The Tea Division of Canadian Products is

Q123: Team incentives encourage cooperation by<br>A)forcing people to

Q157: Some companies present financial and non-financial performance