Multiple Choice

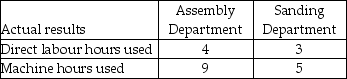

Babcock Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs.The company has two departments: Assembly and Sanding.The Assembly Department uses a departmental overhead rate of $20 per machine hour,while the Sanding Department uses a departmental overhead rate of $15 per direct labour hour.Job 396 used the following direct labour hours and machine hours in the two departments:

The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 396 is $1,200.

What was the total cost of Job 396 if Babcock Industries used the departmental overhead rates to allocate manufacturing overhead?

A) $1,375

B) $1,425

C) $1,500

D) $1,600

E) $1,630

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Outsourcing the accounting function is an example

Q42: Using pages printed as the only overhead

Q49: Activity-based management describes management decisions that use

Q78: Installing a new control panel on a

Q84: Engineering costs incurred to change product designs

Q100: Peanut butter costing involves assigning costs in

Q120: Which of the following is NOT an

Q126: Use the information below to answer the

Q133: Brewery Company operates many bottling plants around

Q136: Significant amounts of direct costs allocated using