Essay

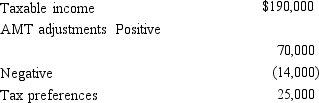

Use the following data to calculate Jolene's AMTI.

Correct Answer:

Verified

Jolene's A...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Jolene's A...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q16: Celia and Christian,who are married filing jointly,have

Q17: In 2014,Glenn had a $108,000 loss on

Q19: In calculating her 2014 taxable income,Rhonda,who is

Q23: Keosha acquires 10-year personal property to use

Q25: Beula,who is a head of household

Q27: Nell has a personal casualty loss deduction

Q48: When qualified residence interest exceeds qualified housing

Q93: Identify an AMT adjustment that applies for

Q96: In calculating the AMT using the indirect

Q106: In deciding to enact the alternative minimum