Essay

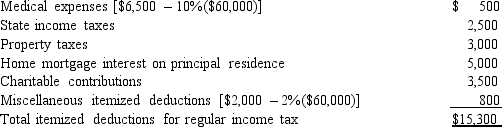

In calculating her 2014 taxable income,Rhonda,who is age 45,deducts the following itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

Correct Answer:

Verified

Rhonda's allowed itemized dedu...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Akeem,who does not itemize,incurred a net operating

Q16: Celia and Christian,who are married filing jointly,have

Q17: In 2014,Glenn had a $108,000 loss on

Q21: Use the following data to calculate Jolene's

Q23: Keosha acquires 10-year personal property to use

Q27: Nell has a personal casualty loss deduction

Q93: Beige,Inc. ,has AMTI of $200,000.Calculate the amount

Q93: Identify an AMT adjustment that applies for

Q96: In calculating the AMT using the indirect

Q106: In deciding to enact the alternative minimum