Essay

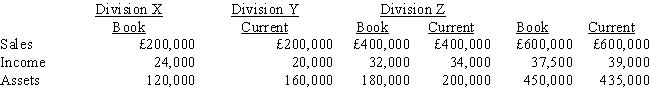

O'Neil Company requires a return on capital of 15 percent. The following information is available for 2002:

Required:

a.

Compute return on investment using both book and current values for each division. (Round answer to three decimal places.)

b.

Compute residual income for both book and current values for each division.

c.

Does book value or current value provide the better basis for performance evaluation?

d.

Which division do you consider the most successful?

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A disadvantage of ROI is<br>A)it leads to

Q6: The Marketing Department is most likely considered

Q20: The operating margin for the Randall Company

Q28: Compare and contrast return on investment (ROI)

Q35: Advantages of decentralization include all of the

Q40: Discuss how firms can evaluate manager performance

Q42: Figure 5<br>The following results for the year

Q45: The compensation package for divisional managers of

Q46: Figure 2<br>The following information was reported on

Q48: Figure 2<br>The following information was reported on