Multiple Choice

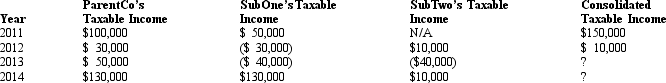

ParentCo and SubOne have filed consolidated returns since 2010.SubTwo was formed in 2012 through an asset spin-off from ParentCo.SubTwo has joined in the filing of consolidated returns since then.Taxable income computations for the members include the following.None of the group members incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.  If ParentCo does not elect to forgo the carryback of the 2013 net operating loss,how much of the 2013 consolidated net operating loss is carried back to offset prior years' income?

If ParentCo does not elect to forgo the carryback of the 2013 net operating loss,how much of the 2013 consolidated net operating loss is carried back to offset prior years' income?

A) $80,000.

B) $40,000.

C) $30,000.

D) $0.

Correct Answer:

Verified

Correct Answer:

Verified

Q110: When excessive negative adjustments are made to

Q111: Which of the following potentially is a

Q113: All members of an affiliated group have

Q114: Consolidated group members each must use the

Q116: When both apply,the § 382 NOL limitation

Q118: A parent-subsidiary controlled group exists where there

Q119: ParentCo and SubCo had the following items

Q120: Which of the following is not a

Q125: ParentCo owned 100% of SubCo for the

Q138: Parent's basis in the stock of Child,