Multiple Choice

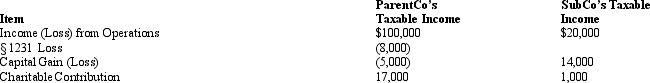

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

ParentCo SubCo

A) $82,800 $33,000

B) $78,300 $30,600

C) $80,000 $33,000

D) $81,000 $33,000

E) $82,800 $30,600

Correct Answer:

Verified

Correct Answer:

Verified

Q4: SubCo sells an asset to ParentCo at

Q61: Business reasons, and not tax incentives, constitute

Q94: When an affiliated group elects to file

Q114: Consolidated group members each must use the

Q115: ParentCo and SubOne have filed consolidated returns

Q116: When both apply,the § 382 NOL limitation

Q118: A parent-subsidiary controlled group exists where there

Q120: Which of the following is not a

Q122: Which of the following items is not

Q138: Parent's basis in the stock of Child,