Multiple Choice

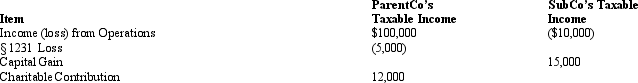

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

ParentCo SubCo

A) $85,000 $5,000

B) $85,000 $3,000

C) $85,500 $5,000

D) $85,500 $3,000

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: ParentCo purchased 100% of SubCo's stock on

Q9: ParentCo and SubCo had the following items

Q15: In a Federal consolidated tax return group,who

Q17: A consolidated Federal income tax return may

Q18: In an affiliated group,the parent must own

Q19: Discuss how a parent corporation computes its

Q52: A subsidiary corporation must leave the consolidated

Q88: The calendar year Sterling Group files its

Q89: ParentCo's separate taxable income was $200,000, and

Q135: The rules for computing Federal consolidated taxable